Vietnam Cold Storage

Market

Post‑2022 buildout is stabilizing; we focus on utilization, unit economics, and tenancy quality across modern cold storage.

Need to Know

Supply caught up; stabilizing

Post‑2022 capacity additions have largely stabilized. Utilization is normalizing, and pricing is rationalizing across key nodes.

Regulatory push

TCVN 12429 series (1: pork, 2: beef/buffalo, 3: poultry) mandates temperature‑controlled handling and storage. For pharma, DAV GDP/GSP certification is required for 2–8 °C distribution — driving upgrades and weeding out non‑compliant nodes.

Highly fragmented market

Long tail of local operators; no clear concentration. Foreign 3PLs expanding selectively; roll‑ups possible but landscape remains fragmented.

Executive Summary

Supply expansion caught up; stabilizing

Post‑2022 buildout ran ahead of demand in some nodes; 2025 shows stabilization with utilization improving and pricing rationalizing. Assets with automation and strong tenants still target 8–12% stabilized yields.

Regulatory compliance mandates upgrades

2021 Food Safety Law requires cold chain for temperature-sensitive products. Pharmaceutical GDP standards push ultra-cold investment. Legacy operators face upgrade-or-exit economics.

Geography: South‑skewed

Southern Vietnam remains the primary concentration, with the Hanoi corridor as a strong secondary hub. Central share is likely understated pending data backfill.

Foreign operators expanding (selectively)

Lineage (via SK Logistics JV) and Yusen scale operations; Japanese groups such as Sagawa and Sojitz‑Kokubu are active in logistics/food distribution. Market remains highly fragmented; consolidation potential exists but no dominant share today.

Investment thesis: land + technology + lease term

Prime logistics land near HCMC/Hanoi up 20–30% since 2023. Automated, multi‑temp facilities command 10–15 year triple‑net leases with blue‑chip tenants (e‑commerce platforms, food processors, pharma distributors).

Our House Views

- 2021–2024 oversupply came from non‑logistics developers building cold stores like ordinary factories/RBF. Cold storage is an operating business requiring specialist design (multi‑temperature, humidity control), validated procedures, and experienced teams.

- A pricing gap then stalled the market. Buyers priced off EBITDA and actual utilization; sellers sought replacement‑cost values. Most potential transactions in 2022–2024 did not close.

- During COVID, seafood inventory hold periods stretched. When export lanes slow, inventory piles up and cold‑storage demand spikes quickly. See our bottom‑up demand calculatorfor how dwell/turnover moves concurrent pallets.

- 2025 shows stabilization and the valuation gap has largely closed. We see an opportunity for transactions in 2026 as pricing converges.

- Long‑term secular trends remain strong: modern trade penetration is ~27% (sub‑30%). There is meaningful runway for food, F&B and frozen categories to keep shifting into supermarkets and organized channels.

Demand Drivers

What pulls cold and cool‑chain capacity across Vietnam

• These drivers create concurrent pallet demand and shape site selection (port‑adjacent vs urban DC), service mix, and pricing power.

Corridor Focus

South port-adjacent throughput vs. North cross‑border quality mix

South Corridor — Long An • HCMC • Binh Duong

Concentrated capacity and recent builds support a twin‑node model: port‑adjacent frozen throughput + urban DC distribution.

- Automated Cold Store (HCMC) ≈ 58,464 pallets

- Transimex Long An (Ben Luc) ≈ 56,000 pallets (ASRS)

- AJ Total Long Hau (Long An) ≈ 31,000 pallets

- Use case: seafood export + frozen prepared foods + retail DCs

North Corridor — Hanoi • Hung Yen • Bac Ninh

“Quality mix” with cross‑border China trade and pharma/cool‑chain distribution; chilled emphasis and border‑oriented lanes.

- SK1 (Hanoi) ≈ 20,000 pallets (est.)

- Lineage (Bac Ninh) ≈ 11,500 pallets

- Flows: durian/banana re‑exports (cool 13–15°C), fresh/chilled poultry & beef, pharma GDP networks

South vs North — At a Glance

South

North

Seasonal Distribution and Reefer Capacity

Monthly share (% of annual volume) and reefer plug snapshot

Seasonal Distribution (% of annual volume) — Durian vs Banana

| Month | Durian | Banana |

|---|---|---|

| Jan | 1 | 7 |

| Feb | 2 | 7 |

| Mar | 4 | 8 |

| Apr | 7 | 8 |

| May | 12 | 8 |

| Jun | 14 | 9 |

| Jul | 14 | 9 |

| Aug | 14 | 9 |

| Sep | 13 | 9 |

| Oct | 10 | 9 |

| Nov | 6 | 9 |

| Dec | 3 | 9 |

Reefer Plugs & Peak Util. (%)

| Port | Plugs | Peak Util. (%) | Source |

|---|---|---|---|

| Cat Lai | 2,500 | 85% | Operator/Customs — under review |

| Cai Mep | 1,800 | 80% | Operator/Customs — under review |

| Hai Phong | 1,600 | 82% | Operator/Customs — under review |

Cold Storage per Urban Resident (GCCA 2020)

m³ per urban resident — selected countries

Cold‑Chain Intensity by Category

Heuristic score combining temp severity, dwell time, and regulatory load

Bottom‑up Pallet Demand

Combine key flows; adjust payload (t/pallet) and dwell (days) to see concurrent pallet demand. Defaults: 0.6 t/pallet, 15 days.

| Category | Tons/month | Dwell (d) | Payload | Concurrent pallets |

|---|---|---|---|---|

| Pork imports (run‑rate) | 8,449 | 7,041 | ||

| Beef imports (run‑rate) | 5,033 | 4,194 | ||

| Poultry imports H1 2025 (run‑rate) | 30,433 | 25,361 | ||

| Seafood exports (annual) | 199,167 | 44,259 | ||

| Durian → China (run‑rate) | 60,083 | 50,069 | ||

| Banana → China (run‑rate) | 38,333 | 31,944 | ||

| Dairy (chilled production subset) | 47,895 | 39,913 |

• Use the calculator to sanity‑check planned capacity and utilization against run‑rate flows and seasonal peaks.

Per‑Capita Cold Storage (m³ per 1,000 people) — GCCA 2020

Public GCCA country table (2020) — use as conservative baseline; 2024 detailed tables are member‑only

| Country | Total (m³) | Pop (2020) | m³ / 1,000 ppl |

|---|---|---|---|

| Vietnam | 2,570,000 | 97.3m | 26.4 |

| Indonesia | 5,310,000 | 273.5m | 19.4 |

| Philippines | 2,400,000 | 109.6m | 21.9 |

| China | 130,950,000 | 1411.8m | 92.8 |

Reefer Plugs by Terminal (selected)

On‑dock power capacity influences dwell and peak export flows

| Terminal | Reefer Plugs | Note | Source |

|---|---|---|---|

| Cát Lái (HCMC) | 1,100 | Plan ~1,426 | TCIT/Operator pages |

| TCIT (Cái Mép) | 1,080 | — | Operator page |

| CMIT (Cái Mép) | 840 | — | APMT CMIT |

| HICT (Lạch Huyện) | — | Not published | HICT |

| HHIT (Lạch Huyện) | 1,350 | — | HHIT |

EVN TOU (2025) + Certified Pharma Nodes + Fleet & Air‑Cargo Cold

Cost timing, regulatory gating, and logistics capacity that shape cold‑chain ops

Pharma GDP/GSP Nodes (searchable)

Use the DAV GxP portal to pull live lists of certified GDP/GSP warehouses and distributors; anchor tenants include Zuellig, DHL, VNVC, Yusen.

DAV GxP Search (GDP/GSP)Air‑cargo perishables

| Operator | Location | Throughput | Temp Bands | Source |

|---|---|---|---|---|

| SCSC | SGN (HCMC) | ~350k t/yr terminal | +15~+25, +8~+12, +2~+8, 0~–5; freezer –18~–21 °C | SCSC |

| NCTS/ALS | HAN (Hanoi) | ~203k t/yr terminal (NIA/NCTS) | cool/cold rooms | Noi Bai Airport |

GACC Durian Gate

China approvals (May 2025): 829 growing areas and 131 packers — indicator of packhouse/packing capacity for China protocols.

Industrial land & rents

| Market | Data point | Figure | Source |

|---|---|---|---|

| Southern VN Tier-1 (industrial land) | Avg rent Q3 2024 | US$174/sqm/remaining term | CBRE HCMC Figures Q3-2024 |

| Southern VN Tier-1 (RBW) | Avg rent Q3 2024 | US$4.6/sqm/month | CBRE HCMC Figures Q3-2024 |

| Southern VN Tier-1 (RBF) | Avg rent Q3 2024 | US$4.9/sqm/month | CBRE HCMC Figures Q3-2024 |

| Southern VN Tier-1 (industrial land) | Avg rent Q4 2024 | US$175/sqm/remaining term | CBRE HCMC Figures Q4-2024 |

| Southern VN Tier-1 (RBW) | Avg rent Q4 2024 | ~US$4.7/sqm/month | CBRE HCMC Figures Q4-2024 |

| Southern VN Tier-1 (RBF) | Avg rent Q4 2024 | ~US$5.0/sqm/month (+2% y/y) | CBRE HCMC Figures Q4-2024 |

| Southern VN Tier-1 (RBW) | Occupancy Q3 2024 | 65% | CBRE HCMC Figures Q3-2024 |

| Southern VN Tier-1 (RBF) | Occupancy Q3 2024 | 88% | CBRE HCMC Figures Q3-2024 |

| Southern Key Economic Zone (industrial land) | Avg ask Q4 2024 | US$176/sqm/lease term | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| Southern Key Economic Zone (RBF) | Avg rent Q4 2024 | US$4.8/sqm/month | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| Southern Key Economic Zone (RBW) | Avg rent Q4 2024 | US$4.5/sqm/month | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| Northern Key Economic Zone (industrial land) | Avg ask Q4 2024 | US$130/sqm/lease term | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| Northern Key Economic Zone (RBF) | Avg rent Q4 2024 | US$4.9/sqm/month | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| Northern Key Economic Zone (RBW) | Avg rent Q4 2024 | US$4.9/sqm/month | Cushman & Wakefield Hanoi All Sectors Q4-2024 |

| North vs South (land) | Expected annual rent growth (3y) | +9% North / +7% South | CBRE (media) |

| Cold storage rent (ops proxy) | Prime rent | US$22–50/ton/month | VietnamNews (industry) |

| BTS (cold/industrial) | Typical lease term | 15–20 years (cold); 10–20 years common | trade.gov (VN cold storage note) |

Industrial TOU — VND/kWh

| Voltage | Off‑peak | Normal | Peak |

|---|---|---|---|

| ≥110 kV | 1,146 | 1,811 | 3,266 |

| 22 kV–<110 kV | 1,190 | 1,833 | 3,398 |

| <6 kV (warehouse typical) | 1,300 | 1,987 | 3,640 |

Fleet snapshot

TCVN cold‑chain standards

| Code | Item | Key Spec |

|---|---|---|

| TCVN 12429-1:2018 | Chilled pork ("Thịt mát") | 0–4 °C storage/transport; definition & cold chain requirements |

| TCVN 12429-2:2020 | Chilled beef/buffalo ("Thịt trâu, bò mát") | National standard for chilled buffalo & beef handling |

| TCVN 12429-3:2021 | Chilled poultry ("Thịt mát - Phần 3: Gia cầm") | National standard for chilled poultry - Part 3 |

Fruit Trade That Needs Cold Chain (Selected)

Durian and bananas to China drive tonnage; temp bands per postharvest standards

Partner‑reported Chinese Customs tonnage gives hard numbers for durian and bananas. Typical export temperatures: durian 13–15 °C, banana 13–14 °C. Total fruit & veg export value in 2024 reached $7.15B.

| Product | Period | Flow | Tons | Value | Temp Band | Source |

|---|---|---|---|---|---|---|

| Durian → China | Jan–Nov 2024 | exports | 721,000 | $2.86B | 13–15 °C | VCCI WTOCenter / Chinese Customs (precise: 720,660 tons) |

| Banana → China | Jan–Aug 2024 | exports | 460,000 | — | 13–14 °C | VCCI WTOCenter / Chinese Customs (precise: 459,940 tons) |

| Fruit & veg (all) | 2024 (full year) | exports | — | $7.15B | — | VietNamNet (MARD/Customs) |

Vietnam Seafood Trade: $10B Export Economy

Seafood exports require port-adjacent blast-freeze and frozen storage

Vietnam's seafood exports reached ~$10 billion in 2024 (+12% y/y), with Jan-Feb 2025 showing +18% growth to $1.42 billion. Major export categories (shrimp, pangasius, tuna, crab) require blast-freeze capacity (-40°C) and frozen storage near ports (Cat Lai, Hai Phong, Cai Mep) for containerized shipments to US, EU, Japan, China.

| Period | Exports | Growth | Imports | Source |

|---|---|---|---|---|

| 2024 (Full Year) | $10.04 billion | +11.9% y/y | ~$2.63 billion | MARD / Vietnam Customs / VASEP |

| H1 2024 | ~$5 billion (est.) | +10-12% y/y | ~$1.22 billion | Vietnam Customs |

| Jan–Feb 2025 | $1.42 billion | +18% y/y | N/A | VASEP (Customs-based) |

| Jan–Sep 2025 | $8.33 billion | +15.5% y/y | N/A | VASEP (Customs-based) |

Cold Storage Implication

Export-grade cold storage must meet international certifications (HACCP, BRC, FDA) and be located within 30-60 min of major ports to minimize logistics costs and preserve product quality.

Operator Note

Blast-freeze (-40°C) throughput and reefer plug access are binding constraints in peak seasons; automation raises turns while stabilizing labor and energy costs.

Quick Service Restaurants — Chain Footprint & Cold Storage Pull

1,022 outlets in 2025; centralized frozen/chilled DCs supply imported categories

| Brand | Units | Year | Notes |

|---|---|---|---|

| Lotteria | 222 | 2025 | Largest by outlets; South Korean brand |

| Jollibee | 213 | 2025 | Vietnam is one of JFC's biggest overseas markets |

| KFC | 172 | 2025 | Solid #3; strong provincial footprint |

| Pizza Hut | 118 | 2025 | Category leader by stores |

| The Pizza Company | 74 | 2025 | Minor Food franchise |

| Domino's Pizza | 59 | 2025 | Nationwide presence beyond HCMC/Hanoi |

| Popeyes | 59 | 2025 | Operated in Vietnam by IPPG/VFBS group |

| Texas Chicken | 42 | 2025 | Smaller but expanding; drove 2025 growth |

| McDonald's | 37 | 2024 | McDonald's corporate reports 37 stores at 2024 year-end (DL market); Q&Me also lists 37 in 2025 |

| Burger King | 11 | 2025 | Small footprint vs peers |

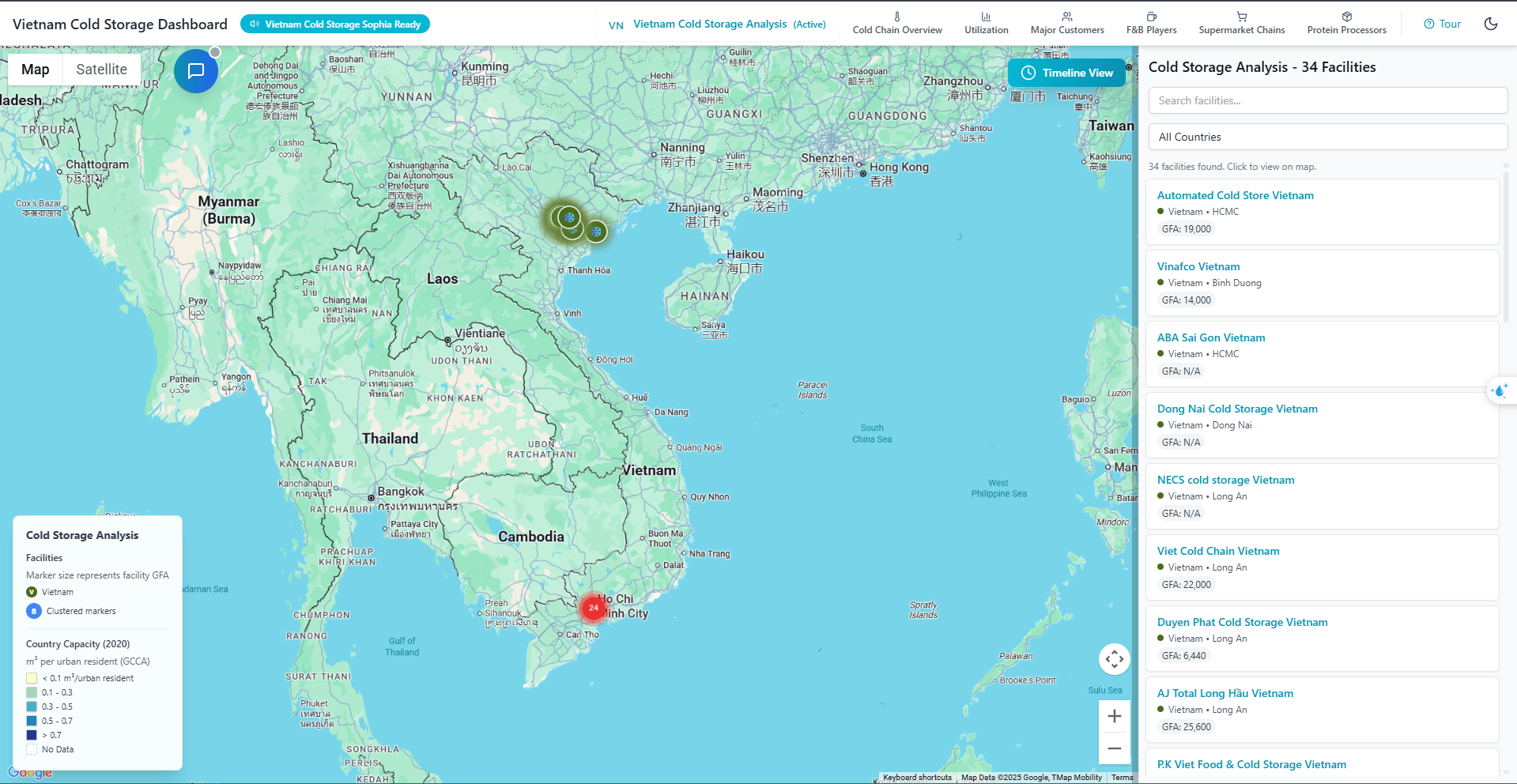

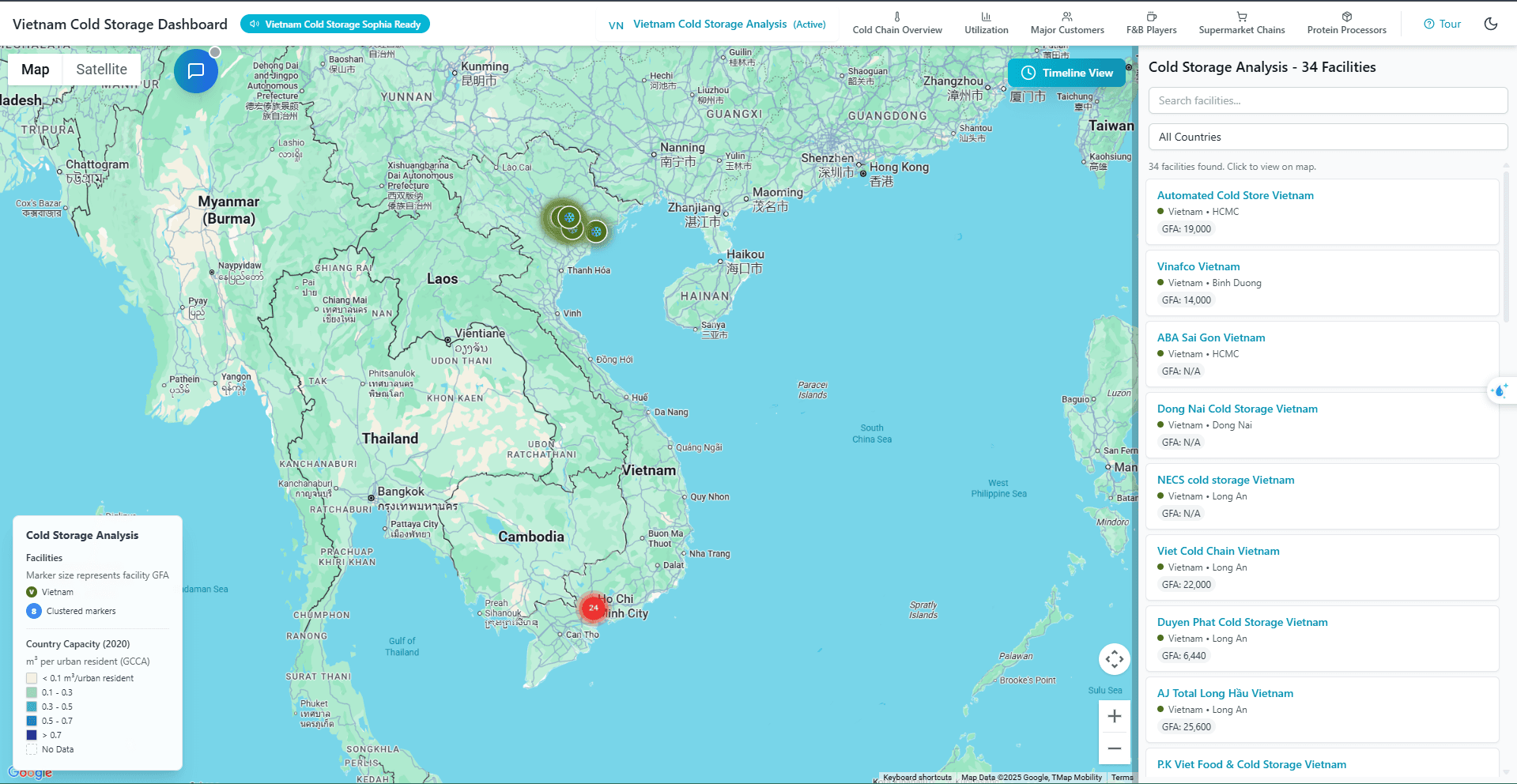

Interactive Cold Storage Map

Our interactive Vietnam Cold Storage map provides comprehensive facility intelligence including GFA, NLA, temperature zones, pallet capacity (58K+ tracked), operator information, and timeline visualization from 2010-2025. Navigate facilities by province, explore capacity heatmaps, and discover infrastructure gaps with Sophia, your Cold Storage AI specialist.

Key Features

- • AI Voice Assistant (Sophia) guided tours

- • Interactive facility markers with details

- • Timeline visualization (2010-2025)

- • Capacity heatmap overlays

Facility Data

- • GFA, NLA, temperature zones

- • Pallet capacity & occupancy rates

- • Operator and ownership info

- • Year-built and facility age

Use Cases

- • Investment due diligence

- • Site selection and gap analysis

- • Competitive benchmarking

- • Market entry strategy

Ice‑Cream — Vietnam

KIDO ~47% share; market $180–190M (2024)

Modern Trade Growth

Mom-and-pop and wet markets continue to cede share to organised retail formats.

Grocery chains and minimarts are scaling nationally, pulling cold chain capacity into cities.

Online grocery adoption requires fast-turn, distributed cold storage to keep pace.

Traditional Trade Declining

From 83% (2015) to 67% (2022). Wet markets and mom-and-pop shops losing share to organized retail.

Modern Trade Expanding

From 17% (2015) to 26% (2022). Modern outlets grew 5× to 9,071 stores, driving DC cold storage demand.

E-Commerce Surging

From 0.4% (2015) to 7.3% (2022). Online grocery/food delivery requires distributed cold chain infrastructure.

WinCommerce × Masan Group: Vertically Integrated Cold Chain Ecosystem

Consumer unicorn leverages 3,500+ stores and 6M+ members across food-to-finance ecosystem

WinCommerce, a subsidiary of Masan Group (one of Vietnam's consumer unicorns), operates over 3,500 WinMart/WinMart+/WIN stores across Vietnam, making it one of the leading corporations in the retail industry.

These stores are well-connected with other products and services under the Masan Group's ecosystem:

- MEATDeli — Chilled meat products

- WinEco — Fresh fruits and vegetables

- Phuc Long — F&B products

- Techcombank — Banking services

- Wintel — Telecommunications

- Dr.WIN — Medicines and healthcare

WIN Membership Program

Preserves connection between consumers and product sources while offering convenience of modern shopping environment.

Cold Storage Implication

Vertical integration from farm/factory → DC → store requires sophisticated multi-temperature cold chain handling MEATDeli (chilled 0-4°C), WinEco (chilled), and Phuc Long F&B (frozen/chilled). 6M+ members with 20% discounts drive predictable volume, enabling long-term cold storage commitmentsand captive demand for build-to-suit facilities near key markets.

Investment Takeaway

Masan Group's ecosystem approach demonstrates how modern retail + vertical integrationcreates embedded, high-volume cold storage demand. Operators serving integrated players like Masan benefit from stable multi-year contracts, predictable throughput, and reduced tenant churn — attractive characteristics for institutional capital seeking yield-focused logistics real estate.

Major Offline Grocery Retailers in Vietnam

Supermarket chains drive cold storage demand at distribution centers

Modern retail chains operate thousands of outlets requiring centralized cold storage at distribution centers. WinCommerce's ~3,500 outlets (with 6M+ WIN members), Bach Hoa Xanh's ~1,700 stores, and AEON/BigC/Fuji networks create sustained demand for multi-temperature warehousing, positioning cold storage operators as critical infrastructure partners for retail expansion.

| Retail Chain | Parent Company | Outlets | Key Regions | Cold Storage Requirements |

|---|---|---|---|---|

| WinCommerce (WinMart / WinMart+ / WiN) | Masan Group (Consumer Unicorn) | ~3,700+ points of sale across 62 provinces | Nationwide; Largest network by store count | Integrated ecosystem DC network: chilled meat (MEATDeli), produce (WinEco), F&B (Phúc Long). 6M+ WIN members. Leverages Masan logistics (Supra). |

| Saigon Co.op | Saigon Union of Trading Cooperatives | ~800+ outlets (all formats) | Nationwide; Strong in HCMC & Southern Vietnam | Multi-format DC network for fresh produce. Strong e-commerce push (30% growth target 2025, VND 3.5T). Expanding Co.op Food aggressively (154 new stores 2025). |

| Bach Hoa Xanh (BHX) | Mobile World Investment Corp (MWG) | ~1,698 stores | Primarily Southern Vietnam (concentrated HCMC) | Regional cold storage hubs for fresh produce at competitive prices. Post-restructuring: closed underperforming stores, focus on profitability. |

| AEON | AEON Group (Japan) | 160+ total business locations (end 2024) | Major cities (HCMC, Hanoi, Binh Duong, Hai Phong, Hue); Expanding Central Vietnam | Centralized cold storage for large-format stores, imported goods. E-commerce (AEON Eshop), private label (Topvalu), loyalty program. |

| Central Retail (GO! / Big C, Tops Market) | Central Retail Corporation (Thailand) | ~77+ stores (all formats) | Nationwide presence (42 malls/hypermarkets across provinces) | Multi-temperature DCs for hypermarket/supermarket formats. Focus on food segment (growth despite 2024 revenue dip). |

| Circle K | Alimentation Couche-Tard (Canada Brand) / GRVI Master Franchisee (HK) | ~476 stores nationwide | Major cities nationwide | 24/7 operations with home delivery services. Distributed cold chain for fresh food, beverages, ready-to-eat meals. |

| GS25 | SonKim Retail (70% Vietnam) & GS Retail (30% South Korea) | ~245-300+ stores (rapidly expanding) | Primarily South (HCMC & surrounding); Expanding nationwide | Fresh food cold chain (IFC advisory on food safety). Modern layout, Korean + local products. Leased warehouse from CJ Logistics. |

| Lotte Mart | Lotte Corporation (South Korea) | ~15 stores | Major cities | Diverse goods including Korean products. Professional service, prominent branding. |

| FamilyMart | FamilyMart Co., Ltd (Japan) | ~160 stores | Primarily South (HCMC & nearby provinces) | Chilled/frozen ready-to-eat meals, beverages. Japanese convenience food standards. |

| 7-Eleven | Seven System Vietnam JSC (CP Group Thailand Master Franchisee) | ~118 stores | Primarily HCMC (concentrated) | Ready-to-eat meals, beverages, ice cream. 24/7 cold chain operations. |

| FujiMart | BRG Group (Vietnam) & Sumitomo Corp (Japan) | ~3 stores in Hanoi (as of 2024) | Hanoi (inner-city residential & high-traffic); Expanding nationwide | Urban cold storage for premium fresh, imported products. Japanese service standards + quality with local understanding. |

| Annam Gourmet Market | Local (French-Vietnamese founders) | ~15 stores | Affluent areas of HCMC & Hanoi | Premium cold chain for imported cheeses, organic products, European cuisine. Specialty cold storage for wine, meats, seafood. |

| Emart | THACO Group (Local Owner) / Shinsegae (Brand Origin - South Korea) | ~1-2 stores | HCMC | Large-format cold storage for Korean products, integrated amenities. |

| B's Mart | Thai Ownership | ~84 stores | Primarily HCMC | C-store cold chain for beverages, ready-to-eat. |

Total Network Scale

Combined ~5,300+ retail outlets across these five chains require regional DC cold storage networks for fresh produce, dairy, frozen foods, and imported goods.

Investment Implication

Long-term contracts with blue-chip retail tenants (Masan, MWG, AEON, Central Group) provide stable cash flows and bankability for cold storage development.

Coffee & F&B Chains: Chilled Dairy & Ingredients

1,400+ outlets across major chains drive centralized cold storage for beverages

Vietnam's coffee and F&B boom creates sustained demand for chilled dairy (milk, cream), frozen ingredients, syrups, and seasonal beverage components. Highlands (750+), Phúc Long (250), and Starbucks (125) require regional distribution centers with temperature-controlled storage to serve hundreds of outlets daily.

| Chain | Store Count | Coverage | Cold Storage Requirements | Source |

|---|---|---|---|---|

| Highlands Coffee | 750+ stores in Vietnam (800+ incl. overseas) | Nationwide, largest coffee chain | Chilled dairy, milk, cream for beverages; frozen ingredients; centralized DC required | diendandoanhnghiep.vn |

| Phúc Long Coffee & Tea | 250 stores (2025, incl. WinCommerce kiosks + standalone) | Urban centers, rapid expansion | Tea products, dairy, seasonal fruits; integrated with Masan ecosystem (WinEco) | Masan Group |

| Starbucks Vietnam | ~125 stores in 16 provinces/cities | Tier-1 & Tier-2 cities | Imported dairy, syrups, seasonal beverages; temperature-sensitive pastries | vietnambiz |

| The Coffee House | Nationwide chain (live count varies) | Major cities | Chilled dairy, blended beverage ingredients | The Coffee House |

| Katinat Saigon Kafe | ~106 stores (Sep 2025, from ~85 end-2024) | Rapid expansion nationwide | Fresh dairy, fruit purées, bakery ingredients | baomoi.com |

| Trung Nguyên Legend Café | ~110 cafés globally | Vietnam + international | Moderate cold storage for dairy and premium beverage ingredients | Wikipedia |

| Cộng Cà Phê | Nearly 100 stores globally | Vietnam + overseas | Coconut milk, dairy, beverage syrups | Cộng Cà Phê |

Cold Chain Requirement

Combined 1,400+ outlets require daily deliveries of chilled dairy products (2-4°C), frozen beverage bases, and temperature-sensitive ingredients. Chains with rapid expansion (Katinat: +21 stores in ~8 months) signal growing DC capacity needs near major urban centers.

Meat & Poultry Processing: Massive Factories + Importers

100M+ broilers/year, 1.4M pigs/year per plant, and documented import operations

Vietnam's meat processing sector features massive integrated factories(CPV Food: 100M broilers/year; Masan MEATLife: 1.4M pigs/year per plant; Vissan: 2,400 pigs + 300 cattle/day) and documented large importers (Vissan: primarily imported Australian beef; JBS Brazil: $100M new plants using Brazilian raw materials). Each requires specialized cold storage: chilled 0-4°C for fresh meat, frozen -18 to -25°C for processed, blast-freeze -40°C for exports.

| Processor | Type | Capacity/Scale | Cold Storage Requirements | Source |

|---|---|---|---|---|

| CPV Food (CP Vietnam / CPF) | Massive integrated factory | 100 million broilers/year (Bình Phước complex) | Large-scale blast-freeze + frozen storage for export; near-port cold chain essential | Vietnam+ (VietnamPlus) |

| Masan MEATLife (MEATDeli) | Massive integrated factory | Two complexes (Hà Nam, Long An): ~1.4M pigs/year each (~140k t/yr per plant) | Chilled 0-4°C distribution to WinMart/WIN stores; integrated with WinCommerce ecosystem | Masan MEATLife |

| Vissan | Massive factory + documented large importer | ~2,400 pigs/day, ~300 cattle/day (HCMC slaughter/processing system) | Chilled/frozen storage for imported Australian beef and domestic pork; urban DC distribution | Vietnam News / Vissan Prospectus |

| Dabaco Group (DABACO FOOD) | Massive integrated factory | Poultry line ~2,000 birds/hour (Denmark line), integrated processing (Bắc Ninh) | Frozen chicken, processed meat cold storage; Northern Vietnam DC hub | Dabaco |

| Koyu & Unitek | Massive factory | ~50,000 chickens/day (Đồng Nai plant); first in Vietnam approved to export chicken to Japan | Frozen export-grade storage; port-adjacent cold chain for Japan shipments | Vietnam+ (VietnamPlus) |

| JBS (Brazil - New Entry) | Documented large importer | $100M investment for two meat plants (MoU signed Mar 29, 2025) | Frozen/chilled storage for imported Brazilian beef/pork; processing + distribution | Reuters |

| GREENFEED (G Kitchen) | Integrated domestic producer | Integrated farm-to-table operations | Chilled/frozen DC for fresh and processed meat brands | GREENFEED Việt Nam |

| Mavin Group | Integrated domestic producer | Farm-to-Table integrated operations | Multi-temperature storage for live-to-processed meat supply chain | Mavin Group |

Massive Factories

CPV (100M broilers/yr), Masan (2.8M pigs/yr across 2 plants),Vissan (2,400 pigs/day), Dabaco (2k birds/hr),Koyu (50k chickens/day). Require on-site blast-freeze + large frozen DC.

Documented Importers

Vissan: Primarily imported Australian beef (live cattle + finished beef).JBS: New $100M plants using Brazilian raw materials. Require port-adjacent frozen storage.

Investment Angle

Vertically integrated producers (Masan, GREENFEED, Mavin) = captive demand for build-to-suit. Export/import players (CPV, Koyu, Vissan, JBS) = port-adjacent frozen with certifications.

Which Food Companies Require Cold/Chilled Storage?

Quick reference: company → product → temperature band

Temperature bands anchor operating specs: Chilled 0–4°C for fresh meat per TCVN 12429; Frozen ≤ −18°C for seafood/meat per Codex;Dairy 2–8°C (yogurts), while UHT milk ships ambient.

| Company / Group | Product Type | Temp Band | Notes | Source |

|---|---|---|---|---|

| Masan MEATLife – MEATDeli | Chilled pork (branded) | Chilled 0–4°C | End‑to‑end chilled chain to retail | MEATDeli |

| VISSAN | Chilled meats / processed | Chilled 0–4°C | Product pages specify storage temp | VISSAN |

| CPV Food (C.P. Vietnam) | Processed chicken exports | Frozen ≤ −18°C (export) | Export poultry handled frozen for trade | Vietnam News |

| Koyu & Unitek | Processed chicken exports (Japan) | Frozen ≤ −18°C | First VN exporter to Japan (processed) | Vietnam News |

| San Hà | Fresh poultry + frozen lines | Chilled 0–4°C; Frozen ≤ −18°C | Fresh requires chilled; frozen lines ≤ −18°C | San Hà |

| Seafood exporters (Minh Phú, Sao Ta, Vĩnh Hoàn, Nam Việt, IDI) | Frozen seafood exports; chilled fish | Frozen ≤ −18°C; Chilled 0–5°C | Codex recommends ≤ −18°C for frozen fishery products | FAO Codex |

| Dairy (Vinamilk, TH, FrieslandCampina, IDP/Kun) | Yogurt/fresh dairy; UHT milk | Fresh 2–8°C; UHT ambient | Labels specify 2–8°C for yogurts | TH True Yogurt |

Coffee Roasteries & Processing Plants

Highlands (10-75k t/yr), Trung Nguyên (largest in SEA), Phúc Long drive cold storage for green beans + distribution

Major coffee chains operate large-scale roasteries and processing plantsrequiring climate-controlled storage for green beans and chilled distribution for retail networks. Highlands' Phú Mỹ II roastery scales to 75k t/yr; Trung Nguyên's Buôn Ma Thuột plant claims to be Southeast Asia's largest (ground broken Mar 2025).

| Company | Facility | Capacity | Cold Storage Need | Source |

|---|---|---|---|---|

| Highlands Coffee | Industrial roastery at Phú Mỹ II | Phase capacity ~10k t/yr, scalable to 75k t/yr (one of VN's largest) | Temperature-controlled storage for green beans; chilled distribution for retail outlets | Highlands Coffee |

| Trung Nguyên Legend | Largest coffee factory in Southeast Asia (Buôn Ma Thuột) | Ground breaking Mar 10, 2025; capacity TBD (largest in SEA claim) | Climate-controlled green bean storage; distribution cold chain for retail network | Trung Nguyên Legend |

| Phúc Long | Tea/coffee processing plants (Bình Dương, Thái Nguyên) | Official large-scale capacity not disclosed; confirmed factories operational | Tea cold storage (oxidation control); chilled distribution for 250+ stores | iPOS |

Cold Chain Requirements

Green bean storage: Temperature/humidity-controlled warehouses to preserve freshness and prevent mold. Retail distribution: Chilled dairy (milk, cream) and temperature-sensitive beverage ingredients for 750+ Highlands, 250+ Phúc Long, 110+ Trung Nguyên outlets.

Major Meat & Chicken Factories

CPV (100M broilers/yr), Masan (280k t/yr), JBS ($100M incoming) drive massive blast-freeze demand

Vietnam's meat processing sector is undergoing rapid industrialization with world-scale integrated facilities from Thai (CPV), Vietnamese (Masan, Dabaco), and incoming Brazilian (JBS) players. These factories require on-site blast freezing, large-scale frozen storage, and cold distribution networks for domestic retail and export markets.

| Company | Location | Capacity | Products | Notes |

|---|---|---|---|---|

| CPV Food (C.P. Vietnam) | Bình Phước export complex | Up to 100M broilers/year | Chicken, Poultry exports | Design capacity post-2023 |

| Koyu & Unitek | Đồng Nai | ~50,000 chickens/day | Poultry | Aimed at Japan exports |

| Masan MEATLife | Hà Nam & Long An (2 plants) | ~280k tonnes/year combined (each ≈140k t/yr BRC) | Chilled pork, Processed meat | Two chilled-meat complexes: MEAT Hà Nam & MEATDeli Sài Gòn |

| VISSAN | Ho Chi Minh City | ~240 pigs/hour + ~30 cattle/hour | Pork, Beef, Processed meat | Modernised slaughter lines per AGM documents |

| Dabaco | Bắc Ninh | ~2,000 birds/hour | Poultry | Denmark slaughter line |

| San Hà | Long An, Đồng Nai (4 plants) + new Bình Định | >200 tonnes/day fresh poultry; new plant: 40k poultry/day + 500 cattle/day | Poultry, Cattle | 4 existing plants; new Bình Định slaughterhouse permitted |

| JBS (incoming) | Vietnam (2 plants planned) | US$100M investment for 2 meat plants | Beef, Processed meat | Will mainly use imported raw materials from Brazil |

| Sojitz – Vinamilk JV (Vinabeef / JVL) | Tam Dao, Vinh Phuc | ~10,000 t/yr chilled beef; 30,000 head/year processing; farm 10,000 head | Chilled beef | Plant operations Dec 2024; first facility designed for chilled beef to Japanese standards; leverages Sojitz four-temperature cold chain |

| Đức Việt (Daesang Đức Việt) | Historic Hanoi factory + Hưng Yên plant | Historic Hanoi: ~30 t/day sausages + ~17 t/day processed meats; Hưng Yên: capacity more than doubled in 2024 expansion | Chilled meats, Sausages, Kimchi, RTE snacks | Finished goods require chiller; some SKUs frozen. Hưng Yên now producing kimchi and hot snacks (no public tonnage) |

Export-Scale Players

CPV Bình Phước: 100M broilers/year design capacity targeting international markets. Koyu (Đồng Nai): 50k chickens/day for Japan exports. Require HACCP-certified blast-freeze + port logistics.

Domestic Integrated Giants

Masan MEATLife: 280k t/yr across Hà Nam + Long An (BRC-certified chilled complexes). Dabaco: Denmark slaughter tech (2k birds/hr). Build-to-suit frozen DC opportunities.

Foreign Direct Investment

JBS (Brazil): $100M for 2 plants using imported Brazilian raw materials. Signals port-adjacent frozen storage demand for import/processing/export flows.

Major Milk (Dairy) Factories

Vinamilk (800M L/yr flagship), TH True Milk (500k t/yr integrated), IDP expanding to 600k t/yr

Vietnam's dairy sector requires end-to-end 2-8°C cold chain from farm collection to 50,000+ retail outlets. Vinamilk operates 13 modern factories nationwide, while TH True Milk pioneered full vertical integration (farm→processing→retail). Foreign multinationals (FrieslandCampina) and domestic players (IDP/LiF/Kun) expanding rapidly.

| Company | Location | Capacity | Plants/Network | Notes |

|---|---|---|---|---|

| Vinamilk | Bình Dương (flagship) + nationwide | ~1.6 million tons/year company-wide; Bình Dương mega factory: 800M liters/year (≈824,000 t/y) | 13 modern dairy factories nationwide (2024 AR) | Vietnam's largest dairy processor; Bình Dương plant opened at 400M L/y phase 1, later doubled. UHT ambient but yogurts/Probi & chilled lines need 0-4°C storage |

| TH True Milk | Nghệ An (Nghĩa Đàn) + new Bình Dương (Sóng Thần 3 IP) | Nghệ An: 200k tonnes/year phase 1; Bình Dương new plant: 852,351 t/y full build-out (4 phases, dairy + beverages) | — | Full farm-to-bottle vertical integration; approved 2025 for Bình Dương expansion. Pasteurized/chilled products require chiller storage; UHT lines ambient |

| FrieslandCampina Vietnam (Dutch Lady) | Bình Dương (1996) & Hà Nam (2008) | 2 production sites; no public tonnage disclosed (multiple expansions at both sites) | — | Dutch multinational, strong market presence. Much of Dutch Lady is UHT ambient; drinking yogurt (YoMost) often UHT but some probiotic SKUs may ship chilled |

| IDP (LiF/Kun) | 2 existing factories + 1 under construction | ~300k tonnes/year (current); another ~300k t/yr (new factory) → ~600k t/yr total capacity | — | Expanding to ~600k t/yr total capacity |

| NutiFood | Bình Dương 1 (14 ha), Hà Nam (8 ha), Hưng Yên 2 (12 ha) | Bình Dương 1: 50,000 t/y powdered milk; Hà Nam: 200M L/y liquid + 31,000 t/y powder; Hưng Yên 2: 24,000 cartons/hour liquid/soymilk | 3 major production sites | Multi-product including coffee. UHT ambient dominates; any chilled yogurt lines would need cold storage |

| Dalatmilk (TH Group member) | Đơn Dương, Lâm Đồng | Historically ~50 t/day; 2 plants being expanded to >240 t/day total capacity | — | Pasteurized/chilled → chiller storage required; some UHT ambient |

Cold Chain Requirements

Farm collection: Milk tankers with 2-8°C refrigeration. Processing plants: Large-scale cold rooms for raw milk holding. Distribution: Chilled trucks + regional cold DCs serving 50,000+ supermarkets/convenience stores nationwide.

Investment Angle

IDP building 3rd factory (+300k t/yr) = immediate DC need for 600k t/yr total. Vinamilk's 13-plant network = multi-region chilled storage consolidation opportunity. Rising fresh milk consumption driving last-mile cold distribution buildout.

Pharma Manufacturers & Cold-Chain Products

Sanofi x VNVC (100M doses/yr vaccine factory 2025), domestic vaccine makers drive 2-8°C infrastructure

Vietnam has 5 major domestic pharma manufacturers with EU-GMP/Japan-GMP lines, plus 4 vaccine producers requiring strict 2-8°C (some -20°C) storage per MOH regulations. Sanofi x VNVC's 100M dose/year factory in Long An (2025 launch) represents significant new cold-chain pharmaceutical infrastructure.

Major Pharmaceutical Manufacturers

| Company | Location | Certification | Capacity | Notes |

|---|---|---|---|---|

| DHG Pharma | Hậu Giang | Japan-GMP lines | — | Building EU/Japan-GMP betalactam factory |

| Traphaco | Hưng Yên | GMP | — | Large GMP factory; ongoing tech-transfer program |

| Imexpharm (IMP) | Multiple factories (IMP2/3/4) | EU-GMP (multiple plants) | — | Multiple EU-GMP factory clusters |

| STADA Pymepharco | Phú Yên | EU-GMP (2 plants) | ~1.2-1.5 billion units/year each | Two EU-GMP plants |

| Domesco (Abbott-linked) | DMC | Upgrading to EU-GMP | — | Upgrading lines toward EU-GMP per AR |

Vaccine Manufacturers (Cold-Chain Required)

| Company | Location | Products | Cold Chain Requirement | Notes |

|---|---|---|---|---|

| VABIOTECH | Vietnam | Vaccines | 2-8°C (some formulations -20°C for long storage) | Domestic vaccine production |

| POLYVAC | Vietnam | Rotavirus vaccine, Other vaccines | 2-8°C (some formulations -20°C) | National vaccine producer |

| IVAC | Vietnam | Vaccines | 2-8°C | Institute of Vaccines and Medical Biologicals |

| DAVAC (Da Lat Vaccine Center) | Đà Lạt | Typhoid vaccine, Other EPI vaccines | 2-8°C (WHO typhoid vaccine storage guidance) | Domestic vaccine producer in Central Highlands |

| Sanofi x VNVC (new) | Long An | Vaccines | 2-8°C per MOH national cold-chain rules | Groundbreaking May 27, 2025; tech-collab MoU with Pfizer on manufacturing know-how; VNVC operates nationwide GSP cold chain incl. 2–8°C and down to −86°C; full ops targeted end-2027 |

MOH Cold Chain Policy

Ministry of Health requires 2-8°C storage for routine vaccines under EPI (Expanded Program on Immunization). Some formulations require -20°C for long-term storage. National cold-chain compliance mandatory.

Sanofi × VNVC Mega-Factory

Groundbreaking May 27, 2025; planned 100M doses/year with full operations targeted end‑2027. VNVC operates a nationwide GSP cold chain (2–8°C and down to −86°C). Tech-collab MoU signed with Pfizer on manufacturing know‑how.

Investment Angle

VABIOTECH, POLYVAC, IVAC = existing vaccine production requiring continuous cold-chain upgrades. EU-GMP pharma plants (Imexpharm, STADA Pymepharco) = temperature-controlled API storage.Specialized 2-8°C facilities with pharmaceutical compliance = high-margin niche.

Largest Seafood Companies by Exports

Minh Phú, Vĩnh Hoàn (No.1 pangasius 10+ years), BIDIFISCO drive $10B+ frozen seafood exports

Vietnam is a global seafood export powerhouse: $10.04B in 2024 (+11.9% YoY) and $8.33B (+15.5%) in 2025 YTD (Jan–Sep), with ~$0.99B (Sep). Top exporters across shrimp (Minh Phú, STAPIMEX, Sao Ta), pangasius (Vĩnh Hoàn #1 for 10+ years), and tuna (BIDIFISCO) require massive blast-freeze capacity, −18°C storage, and frozen export container yards.

2025 YTD (Jan–Sep) Breakdown

By Product

| Category | Value | YoY |

|---|---|---|

| Shrimp | >$3.38B | +20.3% |

| Pangasius (cá tra) | >$1.6B | ~+10% |

| Other marine fish | $1.61B | +18.5% |

| Squid & octopus | ~$550M | +18.7% |

| Tuna | ~$705M | -3.2% |

| Shelled mollusks | ~$192M | +30% |

By Market

| Market | Value | YoY |

|---|---|---|

| China & Hong Kong | $1.76B | +32.1% |

| United States | $1.41B | +6.8% |

| Japan | $1.27B | +15.6% |

| European Union | $885M | +13.3% |

| South Korea | $645M | +13% |

Bottom-up pallet model (exports → pallets)

| Scenario | Pallets | Context |

|---|---|---|

| 2 days | 21,827 | 43.7% of Minh Phú 50k |

Sensitivity by payload (t/pallet)

Lower payloads (e.g., 0.6 t/pallet) increase pallet count; higher payloads (0.8–1.2 t/pallet) reduce it. Values shown for 2 / 7 / 15 days.

| Dwell | 0.6 t/pallet | 0.8 t/pallet | 1.0 t/pallet | 1.2 t/pallet |

|---|---|---|---|---|

| 2 d | 21,827 | 16,370 | 13,096 | 10,913 |

| 7 d | 76,393 | 57,295 | 45,836 | 38,197 |

| 15 d | 163,700 | 122,775 | 98,220 | 81,850 |

Shrimp Exporters

| Company | Ranking | Notes |

|---|---|---|

| MINH PHÚ (MPC) | Top shrimp exporter | Repeatedly among top shrimp exporters in VASEP lists/updates |

| STAPIMEX | Top shrimp exporter | Among top suppliers to the U.S. |

| Sao Ta (FMC) | Top shrimp exporter | Consistently in top rankings |

Seafood Facilities (examples with pallet capacity)

| Company | Site | Pallet Capacity | Notes | Source |

|---|---|---|---|---|

| Minh Phú Seafood (MPC) | Hậu Giang cold storage | 50,000 pallets | Built with Gemadept; at the time, largest in Mekong Delta; planning additional 30–50k pallets at Cà Mau (with Mitsui) | Company/press coverage |

| Vinh Hoan (VHC) | Pangasius processing cluster | ~20,000 pallets (2 facilities, 2020) | Alongside 1,200 t/day fillet capacity; diversified into collagen/gelatin, fish oil/meal | VHC disclosures/press |

| Hung Vuong | HCMC cold storage | ~60,000 pallets | Expansion in 2022-2023 | Orissa International |

| Transimex | Long An Cold Storage | 56,000 pallets | Searefico EPC project note | Searefico |

Pangasius (Cá Tra) Exporters

| Company | Ranking | Notes |

|---|---|---|

| Vĩnh Hoàn (VHC) | No.1 for 10+ years | Dominant pangasius exporter |

| Nam Việt (ANV) | Top pangasius exporter | Decade review ranking |

| Vạn Đức Tiền Giang | Top pangasius exporter | — |

| I.D.I | Top pangasius exporter | — |

Tuna Exporters

| Company | Ranking | Notes |

|---|---|---|

| BIDIFISCO (Bình Định Fisheries) | Top tuna exporter | Leaders cited in VASEP/EU market write-ups |

| Trang Thủy Seafood | Top tuna exporter | — |

| Tuna Vietnam Co. | Top tuna exporter | — |

Cold Chain Requirements

Blast freezing: Rapid freeze to -40°C post-harvest. Frozen storage: -18°C to -25°C warehouses near processing plants. Export logistics: Reefer container yards, cold loading bays at ports (HCMC, Cần Thơ, Đà Nẵng).

Top Markets

USA, EU, China, Japan = primary export destinations. STAPIMEX among top U.S. shrimp suppliers. Vĩnh Hoàn dominates pangasius to North America/Europe. Strict HACCP/BRC/IFS certifications required = premium cold storage facilities.

Investment Angle

VASEP Top 100 includes detailed rankings (paywalled reports). Mekong Delta cluster (pangasius: Cần Thơ, Đồng Tháp, An Giang) + coastal shrimp hubs = port-adjacent certified frozen storage with direct access to export logistics.

World Bank Logistics Performance Index (LPI)

Vietnam ranks 43/139 globally (score 3.3/5.0) — solid mid-tier with room for cold-chain infrastructure upgrades

The World Bank Logistics Performance Index (LPI) measures trade logistics quality across customs, infrastructure, international shipments, logistics service quality, tracking/tracing, and timeliness. Vietnam's rank 43/139 (top 31% globally) reflects improving infrastructure but highlights gaps vs. top performers (Singapore #1, ~4.3 score).

Interpretation

Vietnam's 3.3 score indicates solid mid-tier logistics infrastructure but reveals significant gaps vs. regional leaders (Singapore 4.3, South Korea ~4.0). Improving customs clearance, infrastructure quality, and logistics service reliability remain priorities.

Cold Chain Implication

Specialized cold-chain logistics infrastructure still developing. Gap vs. top performers = opportunity for modern cold storage facilities with best-in-class automation, tracking, and temperature monitoring. As LPI improves, demand for premium cold logistics surges.

Regional Cold Storage Distribution

South leads, Hanoi corridor is the secondary hub; Central is emerging

Pricing & Utilization Since 2022

Stabilization in 2025 with rationalizing rates; capacity metrics under review

2022 Pricing Benchmark

Standard cold storage rate (2022). Pricing has evolved since with energy costs, automation adoption, and supply-demand dynamics.

Key Insight

After rapid expansion, 2025 shows stabilizing utilization and more disciplined pricing. We’re reconciling like‑for‑like capacity units; ton‑based displays are temporarily withheld.

Frozen capex $250–350/m³; leases 10–15 years

Multi‑temperature facilities (chilled 0–5°C; frozen ≤ −18°C) with automation and monitoring command longer leases from blue‑chip tenants. Benchmarks used here are indicative; confirm against current bids.

Cold Storage Facilities & Market Players

International entrants (Lineage, Sojitz, Meito, Yokorei) + domestic leaders (Minh Phu, Vinh Hoan, Masan) — $700M+ invested since 2020

Vietnam's cold storage market is undergoing rapid professionalization with Japanese trading houses (Sojitz, Meito, Yokorei, Kyokuyo), global REITs (Lineage Logistics), and domestic exporters (Minh Phu, Vinh Hoan, Sao Ta) collectively deploying $700M+ since 2020. New facilities feature multi-temperature zones (4+ zones), automation, IoT monitoring vs. traditional single-temp warehouses.

International Players

| Company | Origin | Operations | Capacity | Key Notes |

|---|---|---|---|---|

| Lineage Logistics | USA (Global #1) | Cold storage, Temperature-controlled logistics, Automated facilities | Global network | World's largest cold storage REIT; 2024 JV signals Vietnam market entry |

| Sojitz Corporation | Japan | Cold chain JV, Food wholesale, Integrated meat complex | 39,000 pallet (NLVJ LA) + wholesale distribution | Major Japanese trading house; aggressive Vietnam F&B investments (KOKUBU JV, Vilico beef, Dai Tan Viet acquisition) |

| Meito Vietnam | Japan | Cold storage, Temperature-controlled warehousing | 30,000 pallet (2024 expansion doubled capacity) | Japanese cold storage operator; significant capacity expansion in 2024 |

| Yokorei | Japan | Cold storage, Frozen food logistics | 18,000 pallet (planned Long An facility) | $52M investment planned; targeting export-oriented clients |

| SK Logistics | South Korea | Cold chain logistics, Warehouse management | Via Lineage JV | Partnered with Lineage Logistics for northern market presence |

| Kyokuyo Co., Ltd. | Japan | Seafood processing, Cold storage integration | 5,000 tons/yr (Kyokuyo Vina Foods) | $13.5M investment; diversifying from China to Vietnam for Japan exports |

| JBS | Brazil (World #1 Meat Processor) | Meat processing, Cold storage logistics hubs | $100M for 2 plants (imported materials processing) | World's largest meat processor entering Vietnam; 2025 announced |

| Yusen Logistics | Japan | Cold storage (-20°C), GDP-compliant pharma distribution, Temperature-controlled logistics | ~2,380 pallets cold storage (Binh Duong facility) | ISO 31512:2024 certified (Oct 2025); GDP-compliant pharma cold chain network since Feb 2022 |

Domestic Players

| Company | Operations | Capacity/Investment | Locations | Key Notes |

|---|---|---|---|---|

| Indo-Trans Logistics (ITL) | Cold chain warehousing, Multi-temperature storage, Integrated logistics | 50,000+ cold-chain pallet locations | Da Nang (10k pallets), HCMC, Hanoi | National cold-chain leader (2022-2023 target). IFC $70M financing (2020). Mitsubishi Logistics 20.5% stake (2022-2023). Acquired ITL Keppel 100% (2022) consolidating ~350k m² warehousing. |

| Transimex Corporation (TMS) | Automated cold storage (ASRS), Multi-temperature warehousing, ICD/bonded logistics | 56,000 pallets (Long An Phase 1); additional HCMC/Da Nang sites | Long An (Ben Luc, 56k pallets), HCMC (SHTP 9k m², ICD 3k m²), Da Nang (Hoa Cam, 2017) | VND 1,000B Long An investment (2022-2024); automated ASRS ≈200 pallets/hr, WMS/WCS, 46 docks, solar. Ryobi Int'l Logistics ~21% stake (2020-present) supporting cold-chain expansion. |

| Minh Phu Seafood Corp (MPC) | Shrimp processing, Blast freezing, Cold storage | 30,000-50,000 pallet expansion (Ca Mau) | Ca Mau, Mekong Delta | Vietnam's top shrimp exporter; vertical integration into cold chain |

| Vinh Hoan Corp (VHC) | Pangasius processing, Cold storage, Feed production | VND 540B renovations across value chain | Mekong Delta, Multiple processing sites | #1 pangasius exporter for 10+ years; comprehensive cold chain investments |

| Sao Ta Foods (FMC) | Shrimp processing, Cold storage (6k tons), Integrated farming | 45k tons/yr processing; 6k tons cold storage | Sao Ta, Tam An, ~270ha farms | VND 580B+ investment (2020-2022); doubled processing, tripled farms |

| Masan MEATLife | Chilled pork processing, Cold storage, Distribution | 280k tons/yr (2 BRC-certified plants) | Hà Nam (MEAT), Long An (MEATDeli Saigon) | $77.6M MEATDeli investment (2020); integrated with WinCommerce retail |

| Dabaco Group | Livestock, Feed, Cold chain logistics (ICD), Vaccine development | 8.2ha Inland Container Depot (ICD) | Bắc Ninh, Multiple farm/plant locations | Building dry port logistics hub; diversified into ASF vaccine |

Joint Ventures

| Company | Structure | Operations | Capacity/Scale | Key Notes |

|---|---|---|---|---|

| NLVJ LA (KOKUBU/Sojitz JV) | Japan-Japan JV | Cold chain facility, 4 temperature zones, Multi-temp logistics | 39,000 pallet capacity | Premium multi-temperature facility; serves food distributors |

| JVL / Vinabeef (Sojitz/Vilico JV) | Japan-Vietnam JV | Beef farming (10k head), Chilled meat processing (10k tons/yr) | $500M total scale; $127M Tam Dao complex | Integrated farm-to-processing; premium chilled beef focus |

Key Investment Themes

Japanese Capital Dominance

Sojitz, Meito, Yokorei, Kyokuyo leading FDI in cold chain; diversifying from China risk

- • Sojitz: 3 major deals (KOKUBU JV, Vilico beef, Dai Tan Viet)

- • Meito: Doubled capacity 2024

- • Yokorei: $52M planned

Global REIT Entry

Lineage Logistics (world's largest cold storage REIT) partnering with SK Logistics signals institutional capital interest

- • Lineage/SK JV for North Vietnam market

- • Potential for further acquisitions/build-outs

Vertical Integration by Exporters

Top seafood exporters (Minh Phu, Vinh Hoan, Sao Ta) investing in captive cold storage to control quality & costs

- • Minh Phu: 30-50k pallet Ca Mau expansion

- • Vinh Hoan: VND 540B renovations

- • Sao Ta: 6k ton cold store

Meat Sector Modernization

Foreign processors (JBS, Sojitz/Vilico) + domestic leaders (Masan) building large-scale chilled/frozen facilities

- • JBS: $100M for 2 plants

- • Masan: $77.6M MEATDeli

- • Vinabeef: $127M chilled beef complex

Multi-Temperature Sophistication

New facilities feature 4+ temperature zones (chilled, frozen, ultra-cold) vs. traditional single-temp warehouses

- • NLVJ LA: 4-temp zones (39k pallets)

- • Modern facilities commanding premium rents

Recent Investments & M&A (2020-2025)

$700M+ disclosed deals across cold chain, meat processing, seafood, and logistics infrastructure

The table below summarizes notable recent investments and M&A activity in Vietnam's food processing and cold chain logistics sector since 2020. Includes cold storage facilities, meat/seafood processing plants, distribution networks, and integrated supply chain projects. Japanese capital (Sojitz, Kyokuyo, Meito) and Brazilian meat processor JBS lead foreign investment.

| Investing Company | Target/Project | Sector | Type | Key Details | Year |

|---|---|---|---|---|---|

| Indo-Trans Logistics (ITL) | ITL Logistics Center Da Nang Cold Chain | Logistics (Cold Chain) | Greenfield | 10,000+ pallets, 18,000 m² warehouse, 6 temp zones (-22°C to +25°C), Da Nang. Part of 50k+ pallet network (HCMC/Hanoi/Da Nang) | 2025 |

| Transimex Corporation | Long An Cold Storage (Ben Luc) | Logistics (Cold Chain) | Greenfield | 56,000 pallets, 29,000 m² floor, ASRS (200 pallets/hr), WMS/WCS, 46 docks, rooftop solar, Long An | 2022-2024 |

| Sojitz Corp / KOKUBU Group | NLVJ LA Cold Chain Facility | Logistics (Cold Chain) | JV | 39,000 pallet capacity, 4-Temp Zones, Long An province | 2022-2023 |

| Lineage Logistics | SK Logistics JV | Logistics (Cold Chain) | JV | Partnership to enhance presence in North Vietnam | 2024 |

| Lotte Global Logistics Vietnam | Dong Nai Cold Chain Logistics Centre | Logistics (Cold Chain) | Greenfield | 5.5 ha cold-chain + ambient warehouse, bonded/ICD, rooftop solar (NuriFlex), Nhon Trach 6 IP, Dong Nai | 2025-2026 |

| Meito Vietnam | Cold Storage Facility | Logistics (Cold Chain) | Expansion | Opened 30,000-pallet facility, doubling capacity | 2024 |

| Yokorei | Cold Storage Facility | Logistics (Cold Chain) | Greenfield | Planned 18,000-pallet facility in Long An | Planned |

| Minh Phu Seafood Corp | Cold Storage Facility (Ca Mau) | Logistics (Cold Chain) | Expansion | Planned 30,000-50,000 pallet capacity expansion | Ongoing |

| Sojitz Corp / Vinamilk (Vilico) | JVL / Vinabeef Tam Dao Complex | Meat (Beef) | JV | Integrated Farm (10k head) & Plant (10k tons/yr), Chilled Beef, Vinh Phuc | 2021-2025 |

| JBS | 2 Meat Processing Plants | Meat (Beef, Pork, Chicken) | Greenfield | Processing imported materials, Logistics Hubs, Nam Dinh Vu (North) & South locations | 2025 (Announced) |

| Masan MEATLife | MEATDeli Saigon Processing Complex | Meat (Pork) | Greenfield | Large-scale chilled meat processing plant, Long An province | 2020 |

| Kyokuyo Co., Ltd. | Kyokuyo Vina Foods Factory | Seafood (Fish, Crab) | Greenfield | 5,000 tons/yr capacity, Long An province, Targeting Japan market, Diversifying from China | 2024-2025 |

| Vinh Hoan Corp | Multiple Projects (Hatchery, Cold Storage, Plants, Acquisition) | Seafood, Feed, Food, Logistics | Diversified | Expansion across value chain: farming, processing, value-add, feed, storage, M&A (Sa Giang) | 2020-Ongoing |

| Sao Ta Foods (FMC) | Processing Plants (Sao Ta, Tam An), Farm Expansion, Cold Storage | Seafood (Shrimp), Logistics | Expansion | Doubled processing capacity (to 45k tons/yr), Tripled farming area (~270ha), New cold store (6k tons) | 2020-2022 |

| Mitsubishi Logistics Corp | Indo-Trans Logistics (ITL) | Logistics (Cold Chain & Warehousing) | M&A | Acquired 13.63% (Aug 2022) + 6.87% (Apr 2023) = ~20.5% stake. Supports ITL's 50k+ pallet cold-chain ambitions (HCMC/Hanoi/Da Nang) | 2022-2023 |

| IFC (World Bank Group) | Indo-Trans Logistics (ITL) | Logistics (Cold Chain & Warehousing) | Expansion | Financing package for cold-storage capacity expansion in HCMC and network development | 2020 |

| ITL / ITL Keppel | ITL Keppel Logistics Vietnam | Logistics (Cold Chain & Warehousing) | M&A | ITL acquired 100% of ITL Keppel; consolidated into warehousing/cold-chain company targeting ~350k m² warehousing, ~50k cold pallets (HCMC/Hanoi focus) | 2022 |

| Ryobi International Logistics Vietnam | Transimex Corporation (TMS) | Logistics (Cold Chain & Warehousing) | M&A | Acquired >24% stake in TMS (2020) with explicit cold-chain expansion angle; remains major shareholder (~21% as of 2025) | 2020-Present |

| Sojitz Corp | Dai Tan Viet JSC (New Viet Dairy) | Wholesale Distribution | M&A | Acquisition of largest food wholesaler (40% market share) | 2023 |

| Marubeni Corp | AIG Asia Components | Food Ingredients | M&A | Investment in leading ingredient supplier | 2023-2024 |

| Nutifood Nutrition Food JSC | Kido Frozen Foods JSC | Food (Ice Cream) | M&A | Acquisition of 51-68% of leading ice cream brands & distribution network | 2023-2024 |

| Dabaco Group | Dry Port, Vaccine Facility, Farm/Plant Expansions | Livestock, Feed, Logistics, Pharma | Diversified | Building 8.2ha ICD, Developing ASF vaccine, Expanding farming/processing | Ongoing |

Cold storage deals (headline only)

| Date | Type | Parties | Status | Source |

|---|---|---|---|---|

| 2025-09-15 | New Development | Kido Group × Warburg Pincus | Announced | Deal Street Asia |

| 2025-06-20 | M&A | CJ Logistics acquires VN Cold Chain | Completed | Reuters |

| 2025-03-10 | Partnership | Lineage × Saigon Newport | Under Construction | Supply Chain Dive |

| 2025-Q2 | Expansion | Yusen Logistics Vietnam | Operational | Yusen Logistics press release / Logistics Manager |

| 2024-08-22 | New Development | ESR Group × Kerry Logistics | Under Construction | The Investor |

Cold Chain Focus

Several disclosed cold storage projects and transactions (NLVJ LA, Meito, Yokorei, Minh Phú, Lineage/SK JV) are adding meaningful capacity. We track commissioning timelines and specs.

Integrated Processing

Meat: JBS ($100M), Vinabeef ($127M complex), Masan ($77.6M MEATDeli). Seafood: Kyokuyo ($13.5M), Vinh Hoan (VND 540B), Sao Ta (VND 580B+). All require on-site/nearby cold storage.

M&A Activity

Sojitz acquired Dai Tan Viet (40% wholesale market share). Nutifood acquired Kido Frozen Foods (51-68%).Marubeni invested in AIG (food ingredients). Signals consolidation in distribution/processing.

Comprehensive Cold Storage Facility Inventory

54 tracked facilities across Vietnam: 680k+ pallet capacity, 600k+ m² storage area (2000-2023)

The table below represents a comprehensive inventory of cold storage facilities across Vietnam, including both operational and planned assets. Data includes facility name, location, year established, temperature range, storage area (m²), and pallet capacity. This inventory provides a complete view of Vietnam's cold chain infrastructure landscape from established players (Hoang Lai since 2000, Lotte 2009) to recent entrants (NECS 2023, Lineage 2023).

South Vietnam Facilities (38)

Concentrated around HCMC, Long An, Binh Duong, Dong Nai — serving export ports, urban retail, and food processing clusters.

| Facility Name | Province | Year | Temp Range (°C) | Area (m²) | Pallet Capacity |

|---|---|---|---|---|---|

| Automated Cold Store Vietnam | Ho Chi Minh City | 2021 | -25 to -18 | 19,000 | 58,464 |

| ICD Cold Warehouse Vietnam | Ho Chi Minh City | — | -30 to 10 | 3,000 | — |

| Vinafco Vietnam | Binh Duong | — | — | 14,000 | 14,000 |

| Sunrise Vietnam | Ho Chi Minh City | — | — | — | — |

| ABA Sai Gon Vietnam | Ho Chi Minh City | — | -18 to -5 | — | 25,000 |

| Dong Nai Cold Storage Vietnam | Dong Nai | — | -22 to 22 | — | 8,000 |

| NECS Cold Storage Vietnam | Long An | 2023 | -25 to -18 | — | — |

| Viet Cold Chain Vietnam | Long An | 2022 | -20 to 5 | 22,000 | 12,000 |

| High-tech IP Cold Warehouse Vietnam | Ho Chi Minh City | — | -30 to 10 | 9,000 | 13,000 |

| Duyen Phat Cold Storage Vietnam | Long An | 2021 | -25 to -18 | 6,440 | 14,000 |

| AJ Total Long Hầu Vietnam | Long An | 2021 | -20 | 25,600 | 31,000 |

| P.K Viet Food & Cold Storage Vietnam | Long An | 2019 | -25 to -18 | — | — |

| Hoang Ha Cold Storage Vietnam | Ho Chi Minh City | 2019 | -25 to 10 | 10,000 | — |

| Ryobi Cold Storage Vietnam | Ho Chi Minh City | 2017 | -18 to 5 | — | 8,000 |

| Mien Nam Logistics Vietnam | Binh Duong | 2017 | — | — | 3,000 |

| Phu My Vietnam | Ba Ria - Vung Tau | 2017 | -20 | 7,000 | 16,000 |

| CLK Cold Storage Vietnam | Binh Duong | 2016 | -25 to -18 | 20,000 | 15,000 |

| New Land VJ Cold Storage Vietnam | Binh Duong | 2016 | -25 to -18 | 22,000 | 15,500 |

| Sagawa Vietnam | Dong Nai | 2016 | — | 22,000 | 24,000 |

| Phan Duy Cold Storage Vietnam | Long An | 2014 | — | 22,000 | 30,000 |

| Meito Cold Storage Vietnam | Binh Duong | 2014 | — | — | 30,000 |

| Panasato Cold Storage Vietnam | Binh Duong | 2014 | -22 to -18 | 10,000 | 5,000 |

| Satra Cold Storage Vietnam | Ho Chi Minh City | 2013 | -18 to 5 | 31,000 | 22,000 |

| Kuehne Nagel Vietnam | Dong Nai | 2012 | — | — | 15,000 |

| Hoang Phi Quan Cold Storage Vietnam | Ho Chi Minh City | 2011 | -30 to -15 | — | 20,000 |

| SOTRANS Vietnam | Dong Nai | 2010 | — | — | 15,000 |

| Yusen Logistics Tan Dong Hiep B Cold Storage | Binh Duong | 2025 | -20 (freezer) + chilled/ambient | 2,000 | 2,380 |

| Transimex Long An Cold Storage (Phase 1) | Long An | 2023 | -22 to 6 | 29,000 | 56,000 |

| Lotte Global Logistic Vietnam (Long Hau) | Long An | 2009 | -25 to -18 | 40,000 | 25,000 |

| Lotte Cold Chain Logistics Centre (Dong Nai) | Dong Nai | 2026 | Multi-temp + ambient | 55,000 | — |

| Transimex SHTP Logistics Center Cold Storage | Ho Chi Minh City | — | Cold/cool multi-temp | 9,000 | — |

| Transimex ICD Cold Storage | Ho Chi Minh City | — | Cold storage | 3,000 | — |

| Konoike Vina Cold Storage Vietnam | Ho Chi Minh City | 2008 | -20 to 5 | 3,000 | 1,000 |

| Seaprodex Vietnam | Binh Duong | 2008 | — | — | 9,000 |

| Anpha Cold Storage Vietnam | Long An | 2007 | -25 to 18 | 10,000 | — |

| Hoang Lai 2 Vietnam | Ho Chi Minh City | 2002 | -30 to -15 | — | 1,002 |

| Hoang Lai 1 Vietnam | Ho Chi Minh City | 2001 | -30 to -15 | — | 3,480 |

| Hoang Lai Cold Storages Vietnam | Long An | 2000 | — | 24,000 | 15,000 |

North Vietnam Facilities (21)

Focused on Hanoi, Hung Yen, Bac Ninh, Hai Phong — serving northern industrial zones, port logistics, and urban distribution.

| Facility Name | Province | Year | Temp Range (°C) | Area (m²) | Pallet Capacity |

|---|---|---|---|---|---|

| LP Express 1 Vietnam | Hai Phong | — | -15 to 25 | 1,500 | 2,600 |

| Hanaro Cool and Cold Vietnam | Bac Ninh | — | -25 to 15 | 36,621 | 22,000 |

| Lineage (Previously Emergent Cold) Vietnam | Bac Ninh | 2023 | -25 to 25 | 12,000 | 11,500 |

| AJ Total Pho Noi Vietnam | Hung Yen | 2022 | — | 5,500 | 25,000 |

| ALS New Cold Warehouse Vietnam | Ha Noi | 2021 | -5 to 25 | 1,300 | — |

| LP Express 2 Vietnam | Hai Phong | 2021 | -18 to 5 | 2,000 | 3,000 |

| H&B Logistics Vietnam | Hung Yen | 2020 | — | 7,968 | 15,120 |

| Thang Long Logistics Center Vietnam | Hung Yen | 2018 | -30 to 15 | 5,100 | 8,000 |

| SK 1 Cold Storage Vietnam | Ha Noi | 2017 | -18 to 5 | 30,000 | 20,000 |

| SK 2 Cold Storage Vietnam | Hung Yen | 2017 | -18 to 5 | 8,000 | 2,300 |

| ALS Bac Ninh Vietnam | Bac Ninh | 2017 | -5 to 25 | 10,000 | 5,000 |

| Haiphong Port Services Cold Storage Vietnam | Hai Phong | 2016 | -18 to 5 | 10,000 | 23,000 |

| ABA Ha Noi Vietnam | Ha Noi | 2014 | -25 to 25 | 10,000 | 15,000 |

| Duc Tan Sai Gon | Ha Noi | 2014 | -25 to 5 | 1,100 | 5,000 |

| Nam Ha Noi Vietnam | Ha Noi | 2014 | -30 to 15 | 2,000 | 8,500 |

| Dragon Cold Storage Vietnam | Hung Yen | 2013 | -25 to 15 | 4,500 | 3,000 |

| An Viet 1 | Ha Noi | 2008 | — | 30,000 | — |

| An Viet 2 | Ha Noi | 2008 | — | 30,000 | — |

| An Viet 3 | Ha Noi | 2008 | — | 40,000 | — |

| Aviation Logistics Services 1 Vietnam | Ha Noi | 2008 | -5 to 25 | 5,000 | 10,000 |

| Aviation Logistics Services 2 Vietnam | Ha Noi | 2007 | -5 to 25 | 5,000 | 20,000 |

Key Insights from Inventory Analysis

Geographic Concentration

Long An: 10 facilities (logistics gateway). HCMC: 14 facilities (urban consumption). Binh Duong: 8 facilities (industrial hub). Hanoi: 10 facilities (northern capital).

Facility Vintages

Before 2010: 12 facilities (legacy). 2010-2015: 11 facilities (first wave). 2016-2020: 15 facilities (rapid expansion). 2021-2023: facilities (recent surge).

Top Capacity Leaders

By Pallets: Automated Cold Store Vietnam (58,464). By Area: Lotte Cold Chain Logistics Centre (Dong Nai) (55,000 m²). Japanese operators (Lotte, Meito, Sagawa) and Korean players (AJ Total) dominate large-scale facilities.

Notable Cold Storage Facilities (Operational & Planned)

39k-pallet NLVJ LA (operational), 50k-pallet Minh Phu Ca Mau (expansion), $52M Yokorei Long An (planned)

The following table details specific cold storage facilities that have been announced, under construction, or recently completed. Long An province emerges as the logistics hub(NLVJ LA, Yokorei, Kyokuyo, Masan MEATDeli) due to proximity to HCMC markets and port access. Mekong Delta (Ca Mau, Mekong) serves seafood processing clusters.

| Company/Operator | Facility Name | Location | Capacity | Key Features | Status | Year |

|---|---|---|---|---|---|---|

| Sojitz Corp / KOKUBU Group | NLVJ LA Cold Chain Facility | Long An province | 39,000 pallet capacity | 4 temperature zones, Multi-temperature capability | Operational | 2022-2023 |

| Minh Phu Seafood Corp | Cold Storage Facility | Ca Mau province | 30,000-50,000 pallet capacity (planned expansion) | Blast freezing, Frozen storage for seafood exports | Under Construction | Ongoing |

| Sao Ta Foods (FMC) | Integrated Cold Storage Complex | Sao Ta, Tam An facilities | 6,000 tonnes capacity | Processing plant integration, Farm-to-storage vertical integration | Operational | 2020-2022 |

| Meito Vietnam | Cold Storage Facility (Expansion) | Vietnam | 30,000 pallet capacity (doubling total capacity) | Modern automation, Temperature monitoring | Operational | 2024 |

| Yokorei | Cold Storage Facility (Planned) | Long An province | 18,000 pallet capacity | Japanese standards, Export-focused | Planned | Planned |

| Lineage Logistics / SK Logistics | Joint Venture Cold Chain Network | North Vietnam | Undisclosed | International standards, Automated systems | Operational | 2024 |

| Indo-Trans Logistics (ITL) | ITL Logistics Center Da Nang Cold Chain | Da Nang | 10,000+ pallet positions; ~18,000 m² warehouse area | Six temperature zones (-22°C to +25°C), International standard, ~5,200 m² cold zones | Operational | 2025 |

| Transimex Corporation | Long An Cold Storage (Ben Luc) | Ben Luc, Long An province | 56,000 pallet positions; ~29,000 m² floor area | ASRS (≈200 pallets/hr), WMS/WCS (System Logistics, Infor), 46 docks, Rooftop solar, Multi-temp: -18°C to -22°C; +2°C to +6°C; ambient | Operational | 2023-2024 |

| Lotte Global Logistics Vietnam | Dong Nai Cold Chain Logistics Centre | Nhon Trach 6 Industrial Park, Dong Nai | ~5.5 hectares; cold-chain + ambient warehouse | Bonded/ICD functions, Integrated import-export, Rooftop solar (NuriFlex partnership), Multi-temperature zones | Under Construction | 2025-2026 |

| Vinh Hoan Corp | Multiple Cold Storage Projects | Mekong Delta | Various capacities | Integrated with processing plants, Pangasius export focus | Operational | 2020-Ongoing |

| Yusen Logistics | Tan Dong Hiep B Cold Storage | Tan Dong Hiep B IP, Di An City, Binh Duong | ~2,380 pallet positions; ~2,000 m² storage area | -20°C freezer facility, GDP-compliant pharma distribution network, ISO 31512:2024 certified (Oct 2025), Integrated with national pharma network | Operational | 2025 |

Geographic Hotspots

Long An: 4 major projects (NLVJ LA, Yokorei, Kyokuyo, Masan) = logistics gateway to HCMC + ports. Ca Mau/Mekong Delta: Seafood processing clusters (Minh Phu, Vinh Hoan, Sao Ta). North Vietnam: Lineage/SK JV targeting emerging industrial zones.

Investment Angle

Multi-temp facilities commanding 20-30% rent premiums vs. single-temp warehouses. Japanese operators (Meito, Yokorei) targeting export-oriented tenants (seafood, food processors). Domestic exporters (Minh Phu, Vinh Hoan, Sao Ta) = captive demand for build-to-suit opportunities.

Cold Storage Specifications & Economics

Capex, lease terms, and use cases by temperature category

| Category | Primary Use | Typical Lease | Capex/m³ |

|---|---|---|---|

| Chilled (+0°C to +5°C) | Fresh produce, dairy, beverages | 7-10 years | $180-250/m³ |

| Frozen (-18°C to -25°C) | Meat, seafood, frozen foods | 10-15 years | $250-350/m³ |

| Ultra-cold (-40°C to -80°C) | Pharmaceuticals, vaccines, biologics | 5-10 years | $400-600/m³ |

| Quick-freeze (blast freeze) | IQF seafood, processed foods | 5-7 years | $300-450/m³ |

- South: 65% / 75% / 85% (low/base/high)

- Central: 55% / 70% / 80% (low/base/high)

- North: 60% / 72% / 82% (low/base/high)

Pharmaceutical Cold Chain: Ultra-Cold & GDP-Certified

High-value, low-volume segment with premium economics

- GDP certification mandatory for pharmaceutical cold chain operators. Drives capital investment in monitoring, backup power, validated processes.

- Ultra-cold storage (-40°C to -80°C) required for vaccines, biologics, mRNA therapeutics. Capex $400-600/m³, commanding premium rents.

- Distributed network essential — last-mile delivery to hospitals, clinics, pharmacies requires urban cold chain nodes with <2hr delivery radius.

- International pharma expansion in Vietnam (manufacturing, R&D) creates captive demand for specialized cold storage with compliance track record.

- Lease terms 5-10 years, typically with escalation clauses and capital recovery provisions. Lower tenant churn vs food/beverage segments.

Segment Economics

Key Opportunity

Build-to-suit ultra-cold facilities for international pharma distributors entering Vietnam market. Long-term triple-net leases with creditworthy tenants (e.g., Zuellig Pharma, DHL Healthcare, Nipro) offer stable cash flows and limited operational risk for institutional investors.

| Facility | Province | Scope | Cert | Valid to | Source |

|---|---|---|---|---|---|

| VN Pharma Logistics JSC | Ho Chi Minh City | GDP | — | — | DAV GDP portal |

| Imexpharm Distribution Center | Dong Thap | GDP | — | — | DAV GDP portal |

| Pymepharco Storage | Phu Yen | GSP | — | — | DAV GDP portal |

Operational Insights — Embedded

Rendered from our insights engine (opens in-place)

Sources

- GA Capital — Vietnam Cold Storage Analysis (2022, 2025)

- Vietnam Ministry of Industry & Trade — Cold Chain Strategy

- CPF Worldwide — CPV Food Bình Phước Complex (100M broilers/yr)

- Đồng Nai Portal — Koyu & Unitek Japan Exports (50k chickens/day)

- Masan Group — Vietnam Meat Industry Modernization (280k t/yr)

- Vietstock — Vissan AGM Resolutions (240 pigs/hr, 30 cattle/hr)

- Dabaco — Foodstuffs Processing Co. (2k birds/hr Denmark line)

- San Hà — Poultry Processing Network (4 plants, new 40k/day)

- Reuters — JBS $100M Vietnam Investment (2 plants, Brazilian imports)

- Reuters — Sanofi, VNVC launch vaccine factory in Vietnam (May 27, 2025)

- MEATDeli — Product info (chilled 0–4°C)

- VISSAN — Product storage (0–4°C)

- San Hà — Fresh & frozen poultry

- FAO — Code of Practice for Fishery Products (≤ −18°C)

- TCVN 12429 — Chilled meat 0–4°C

- VASEP — Exports accelerate Jan–Sep 2025

- Nhan Dan Online — Vinamilk Mega Factory 800M L/yr (Bình Dương)

- Asem Connect Vietnam — Vinamilk Company-Level Capacity 1.6M tons/yr

- VnEconomy — Vietnam Dairy Production 1.86B L (2023 GSO)

- Vietnam News — Vinamilk Network (13 factories, 800M L/yr flagship)

- The Investor — TH True Milk $234M Bình Dương Factory (852k t/y full build-out)

- TH Group Global — Fresh Clean Milk (500k t/yr integrated)

- VIIPIP — FrieslandCampina Sustainable Growth in VN (Bình Dương & Hà Nam)

- FrieslandCampina — Vietnam Operations (Bình Dương & Hà Nam)

- VIETCAP — IDP Analysis (300k t/yr + 300k t/yr expansion)

- Nutifood — Goodness from Farm to Glass (3 plants, powdered + liquid)

- Dalat Trip — Dalatmilk Farm (2 plants expansion to 240t/day)

- Vietnam Agriculture — Vinasoy Top 50 Corporate Sustainability (390M L/yr)

- Báo Bình Dương — Bel Vietnam Cheese Plant 10,000 t/yr

- VIR — KIDO Frozen Food IPO (50M L/yr ice cream + yogurt)

- Betrimex Vietnam — Leading Coconut Producer (37-46M L/yr)

- Vietnam News Agency — Đức Việt Trademark Sausages (30t/day + 17t/day)

- InvestVietnam — Daesang Expands Production Capacity (Hưng Yên)

- VIR — Foreign Brands Keep Convenience Store Dominance (Circle K 460+ stores)

- DC Velocity — Circle K Smart Warehouse Asia (Hong Kong model)

- ABA Cooltrans — Fresh DC Thủ Đức (2 cold stores, 300 reefers)

- DHG Pharma — Japan-GMP Lines & Betalactam Factory

- Traphaco — Modern Medicine Factory Inauguration

- Imexpharm — EU-GMP Quality Medicines

- STADA Pymepharco — EU-GMP Plants (1.2-1.5B units/yr each)

- Domesco — Annual Report 2024 (EU-GMP Upgrade)

- Vietnam+ — VABIOTECH Leading Vaccine Manufacturer

- Reuters — Sanofi VNVC Vaccine Factory Launch (100M doses/yr)

- Thư viện Pháp luật — Decision 1210 COVID-19 Vaccine Storage (2-8°C)

- Vietnam Fisheries Magazine — Seafood Exports $10.04B Full Year 2024 (Vietnam Customs)

- VASEP — Seafood Exports Jan-Sep 2025 YTD $8.33B

- VASEP — Top 10 Shrimp Exporters (Minh Phú, STAPIMEX, Sao Ta)

- VASEP — Top Pangasius Exporters (Vĩnh Hoàn #1 for 10+ years)

- VASEP — Vietnam Tuna Exports to Spain (BIDIFISCO, Trang Thủy)

- VASEP — Report on Vietnam Seafood Exports in 2024 ($10B)

- VnExpress — China Imports 721,000 tons Durian from Vietnam (Jan-Nov 2024)

- VCCI WTOCenter — Durian 720,660 tons Jan-Nov 2024 (Chinese Customs)

- HCMC ITPC — China Durian Imports 721k tons

- VCCI WTOCenter — Banana 459,940 tons Jan-Aug 2024 to China

- VCCI — Vietnam Largest Banana Supplier to China

- WITS/UN Comtrade — HS 200410 Vietnam Imports 2023 (26,400.6 tons, $40.644M)

- World Bank LPI — Vietnam Rank 43/139 (Score 3.3)

- World Bank LPI — Full 2023 Report & Dataset

- Masan Group — Modern Trade & Consumer Ecosystem

- MARD / Vietnam Customs / VASEP — Seafood Trade Data

- Highlands Coffee — Phú Mỹ II Roastery (10-75k t/yr scalable)

- Trung Nguyên Legend — Largest SEA Coffee Factory (Mar 2025)

- iPOS — Phúc Long Processing Plants (Bình Dương & Thái Nguyên)

- Highlands Coffee — Expansion Strategy

- Vietnambiz — Starbucks Vietnam Coverage

- Baomoi — Vietnam Coffee Chain Competition

- GREENFEED Việt Nam — 3F Integrated Operations

- Mavin Group — Farm-to-Table Meat

- Vietdata Research — Vietnam Animal Feed Industry

- WTO Center — Russia-Vietnam Fish Trade

- VCCI — Logistics & Cold Chain Reports

- Kido Group — Annual Reports & Investor Presentations

- Deal Street Asia — Cold Storage M&A Coverage

- JLL Vietnam — Industrial & Logistics Market Reports

- CBRE Vietnam — Cold Storage Sector Analysis

- Cushman & Wakefield — Vietnam's Cold Chain Market Boom

- Savills Vietnam — Cold Storage Warehouse Rising Demand 2024

- TechSci Research — Vietnam Cold Chain Logistics Market Forecast

- FiinResearch — Vietnam Cold Chain Market Report 2024

- FiinGroup — Vietnam Cold Chain: What's Next After Huge Investment

- Vietnam Briefing — Cold Storage Industry: Drivers, Challenges & Market Entry

- Euromonitor — Vietnam Food Retail & E-commerce

- Vietnam E-commerce Association (VECOM)

- Alvarez & Marsal — Vietnam Logistics Report

- B-Company — Food Cold Chain in Vietnam: Promising Chance in Future

- ERIA — Overview of Cold Chain for Agriculture in Vietnam (Chapter 3)

- Global Angle — Vietnam Supply Chain and Distribution

- Oracle Vietnam — How Grocery Store Supply Chains Work

- Makreo — Vietnam Cold Chain Market Size & Forecast 2019-2029

- USDA FAS — Retail Foods Annual Report (Vietnam)

- USDA FAS — Vietnam Retail Foods Sector Report 2018

- B-Company — Modern Trade Leading Vietnam's Retail Market

- The-Shiv — Vietnam Supermarkets: Foreign Retailer's Guide 2025

- Deloitte — Retail in Vietnam: Navigating Digital Retail Landscape

- Visa — Chợ Reimagined: Changing Retail Landscape in Vietnam

- The Supply Chain Lab — Traditional Trade vs Modern Trade Differences

- Mojro — General vs Modern Trade: Impact on FMCG Logistics

- Canada Agriculture — Vietnamese Market Overview

- Canada Agriculture — Packaged Food Trends in Vietnam

- The Investor — Fast Food Stores in Vietnam Rise 12% in 2025 (Q&Me Census)

- McDonald's Corporation — Restaurants by Market 2024 (Annual Data)

- Vietnam News — Vietnam to Spend $1.7B on Meat Imports (2024)

- USDA FAS — Vietnam Food Service - Hotel Restaurant Institutional

- Tuoi Tre News — WinCommerce Supra DC Network (4 cold + 6 dry, 60% throughput)

- Masan Group — Modern Trade & Prospects Towards Consumer Unicorn

- VN Express — How WinCommerce Modernizes Grocery Retail in Vietnam

- Masan Group — WinCommerce's 'Point Of Life' Strategy Gets Upgrade

- The Investor — WinCommerce Reports Profit for First Time Since Masan Acquisition

- PE Hub — Bain Capital Invests $200M in Masan Group

- Just Food — Masan Group Backed by Bain Capital $200M

- Vietnam News — Masan Posts $79.9M Profit in 2024, 52% Growth Target 2025

- Clifford Chance — Bain Capital's $250M Investment into Masan

- Vietnam News — MCH to be Listed on HOSE in 2025

- MM Vietnam — Frozen Food Cold Storage

- KIS Vietnam Securities — MWG Cold Storage (2 DCs, -18°C frozen, 0°C chilled)

- Tuoi Tre — Saigon Co.op Green Warehouse Investment (Logistics SVI-1)

- Saigon Co.op — Company News

- Saigon Co.op — Co.op Food Division

- Vietnam News — Saigon Co.op Targets 30% Growth in Online Sales

- LinkedIn — Central Retail Vietnam (Partner cold-chain references)

- AEON Vietnam Company Profile — Retail Operations

- AEON Vietnam — Leading Japanese Supermarket

- Go Global MOIT — Vietnam Continues to be Key Market for AEON Expansion

- Nam Phú Thái — Tiki Cold Storage Installation (Long Biên HN, District 6 HCMC)

- Business Times — Sendo Farm Fresh Logistics

- SPX Express Vietnam — Logistics Services

- Vietnam News — AEON Vietnam Boosts Recruitment & Expansion 2025

- Vietnam+ — Japanese Retailer AEON Boosts Recruitment 2025

- Euromeatnews — AEON Plans Large Expansion in Vietnam

- The Investor — Central Retail's Vietnam Revenue $1.4B in 2024

- Central Retail — Understanding Central Retail

- VIR — BJC BIGC Thailand Continues Investment Expansion in Vietnam

- Vietnam News — BJC BIGC Thailand Expansion into Việt Nam's Retail Market

- The Investor — Fierce Race for Convenience Store Pie in Vietnam

- VIR — Convenience Store Chains Grasp Vietnam's Promise

- VIR — Convenience Stores Remain Aggressive

- Vietdata — Convenience Store 2023: Which Brand Dominating Market

- Circle K — International Master License Program

- KED Global — GS25 Becomes No.1 Convenience Store in Southern Vietnam

- IFC Disclosure — GS25 VN Project (AS-ESRS)

- IFC Disclosure — GS25 VN Project (SII)

- VIR — IFC Investments to Strengthen Agribusiness Value Chain

- The Asset — IFC to Invest $20M in Vietnamese Store Chain GS25

- KrASIA — SF Express Eyes Bigger Pie in Vietnam Logistics with JV

- BRG Group — Retail Division

- Sumitomo Corp — Expanding Grocery Retail Business in Vietnam (50 FujiMart)

- The Investor — Sumitomo, BRG Group to Expand FujiMart Store Chain

- Vietnam+ — BRG Group, Japanese Partner to Open More FujiMart Stores